At PDX Parent, we were curious about how our readers were spending their child tax credits and what the program meant to them. We spoke to three families in the community to learn how the payments have made a difference.

In July, most U.S. parents received the first monthly payment of the child tax credit. This federal tax benefit is meant to offset some of the many costs associated with child rearing. At approximately $300 per month, per child, this benefit will provide much needed relief to budgets that have been stretched to breaking by the pandemic. These payments will continue to the end of the year, with another lump sum paid in the spring of 2022. With an estimated 864,636 children living in Oregon, that’s a lot of direct deposits and checks in the mail.

If you filed taxes in 2019 or 2020, or if you applied for the Economic Impact Payment as a non-filer, you were automatically enrolled in the payment program and should already have received your first payment. If that’s not you, you need to fill out a form with the IRS to make sure you get your child’s credit.

While technically an advance on a 2021 tax benefit, the child tax credit operates like a universal basic income for children. While many countries have similar programs for families, this is a first for the U.S. The only families excluded from the credit are the extremely wealthy, though some families will receive smaller payments if their children are older or if their income is greater than $150,000 for couples filing jointly. This means almost every family will receive the credit.

Roshan Bellavara is a father of two, ages 7 and 11, in Southeast Portland. He works for a software company in Beaverton, and his wife Holly is a stay-at-home mom. Early in the pandemic, the children’s maternal grandfather passed away, and — because of pandemic restrictions—none of them could say goodbye. While grieving the loss of Holly’s father, the family also had to tighten their budget due to uncertainty about Roshan’s employment. While he was able to stay employed throughout the pandemic, he did change jobs, which was stressful with remote employment. The family saved what they could to ensure they could handle a month or two of job searching, if needed. They haven’t been able to visit Roshan’s family in India in a long time, and with children too young to be vaccinated and a careful budget, the wait for Roshan’s parents to see their only grandchildren continues. How did they spend the child tax credit? After a year and a half of no extras, they were able to take a family vacation to central Oregon. Roshan says it felt good to give the children a slice of normal Oregon summer after so much caution. “It was a nice bridge to normalcy,” he says. It wasn’t a trip to India, but it was something.

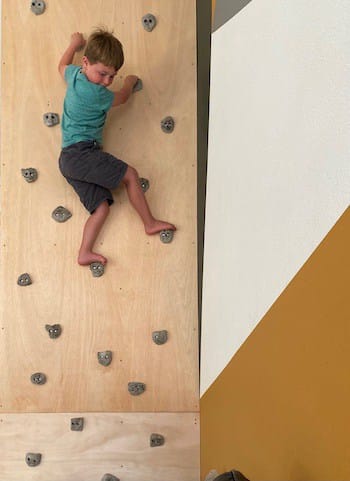

Nick Pederson and his partner have two young children, ages 3 and 6, and they live in Vancouver, WA. During the pandemic they were both able to keep their jobs, though with two small children and an increased workload, it was an exhausting time. When the child tax credit payment arrived, they decided to spend the money on building an indoor climbing wall for their children. It was hard to get enough exercise for the children during the pandemic, he says, and the rock wall was a way to make it fun and easy to move their bodies enough to stay healthy at home. “They’re pretty young and we couldn’t take them out to the playgrounds, and they were gaining weight from inactivity,” Nick says. He was able to hire a friend who was unemployed to help him build the bouldering rock wall, using the tax credit.

Blanca Vasquez has lived in the United States for 22 years and is a mother of three, ages 14, 12 and 8. She is married, but separated from her former partner. Because her spouse pays the taxes for their family and has the only bank account, Blanca has not been able to access the child credit for her children. She is not sure if it has been received, but says she desperately needs the money to pay for backpacks, clothes that fit, school supplies and winter coats for her three children. Before becoming a parent, Blanca worked as a bilingual storyteller, tutor and Spanish instructor. After the birth of her children, their medical needs became significant enough that she was forced to give up regular employment for something more flexible. She now cleans homes, and house- and pet-sits for families in the community. After leaving her husband, she couch-surfed for around five years, but when the pandemic hit, she and the children were forced to temporarily move back in with him. “It was a difficult time,” she says. She says she is grateful to the families who continued to pay her during the pandemic, even though she wasn’t able to come to their homes and clean during lockdown: “It was enough to put food on the table for my kids.” She continued to look for a shelter but had no luck. Today, thanks to Central City Concern, she and her children are living in a room of their own, and Blanca is able to see a counselor. “They are helping people like me who have fallen through the cracks,” she says. When asked if she thinks she will ever see the child tax credit payments — which would be close to $1,000 a month for her three children — she remains upbeat. “I’ll keep asking,” she says.